Recessions significantly impact the real estate market by lowering property values and buyer confidence, but they also create opportunities for savvy investors. During economic downturns, these investors can identify undervalued properties in emerging areas through strategic analysis, negotiation, and creative approaches like fix-and-flip projects. By securing discounted prices during a buyer's market, they position themselves for substantial gains when the economy recovers.

Recessions can be challenging, but they also present unique opportunities for savvy real estate investors. In this article, we explore how understanding recessions and their impact on the market can help you identify discounted properties and seize profitable deals. We’ll guide you through strategies to navigate economic downturns, from recognizing signs of a downturn to implementing successful investment tactics in a recessionary market, all centered around the dynamic world of Real Estate.

Understanding Recessions and Their Impact on Real Estate

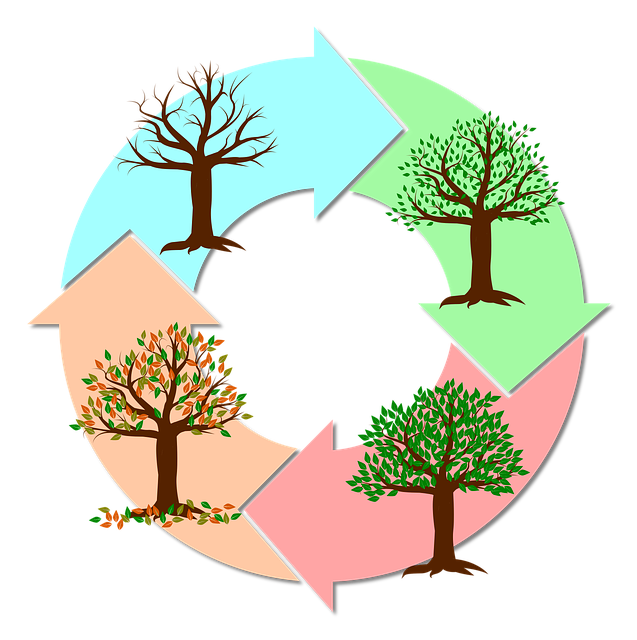

Recessions, characterized by declining economic activity and a contraction in gross domestic product (GDP), significantly impact various sectors, including real estate. During these periods, property values often experience a downturn as buyer sentiment wanes and market liquidity tightens. Many prospective homebuyers become more cautious, opting to rent or delay major purchases, which can lead to increased vacancy rates and lower rental incomes for developers and landlords.

In the real estate sector, recessions create opportunities for savvy investors who recognize discounted prices and potential long-term gains. It allows buyers to acquire desirable properties at reduced rates, offering an advantage in a buyer’s market. Moreover, property values tend to bottom out during recessions, presenting a chance to invest in undervalued assets with the potential for significant appreciation once the economy recovers.

Identifying Discounted Opportunities in Real Estate During Economic Downturns

During economic downturns, real estate often experiences a decrease in property values and a slowdown in market activity. This presents an opportunity for savvy investors to identify undervalued properties at discounted prices. By carefully analyzing market trends, local economies, and individual property conditions, investors can pinpoint real estate gems that offer significant returns once the market recovers.

Recessions can lead to foreclosures and distressed sales, providing a wealth of options for those willing to buy below market value. These opportunities allow investors to secure prime locations at lower costs, potentially generating substantial profits in the long term. Real estate investment strategies during economic downturns require thorough research and a nuanced understanding of market dynamics, but they can be highly rewarding.

Strategies for Seizing Profitable Deals in a Recessionary Market

During recessions, the real estate market often experiences a downturn, leading to lower property prices and more affordable options for buyers. This presents an opportunity for strategic investors to seize discounted properties, anticipating future growth. One key strategy is to focus on undervalued assets in emerging or revitalizing neighborhoods; these areas may have been overlooked during the boom, but they hold potential for significant appreciation over time.

Additionally, negotiating skills become paramount. Investors should engage with sellers who are motivated to close deals quickly, offering competitive yet reasonable bids. A flexible approach, coupled with a deep understanding of market trends and local dynamics, can help secure profitable deals. This might include considering alternative financing options or creative investment strategies, such as fix-and-flip projects, to maximize returns in a recessionary market.